Blockskye Launches Blockskye Capture™ to Eliminate Corporate Expense Management While Maximizing Traveler Rewards Up to 37%

Enterprise travel teams gain real-time spend visibility and compliance control with AI, while travelers earn loyalty points and status on every trip.

Boston, MA, January 28, 2026: Blockskye today announced the launch of AI-powered Blockskye Capture™, a new expense tracking and reimbursement solution for enterprise travel programs. Capture allows employees to use their preferred personal credit cards for business travel expenses while maximizing loyalty points and status, while giving corporate buyers real-time visibility, policy controls, and audit-ready records. With Capture, traditional, manual expense reporting is no longer required.

Capture works by aligning corporate compliance with traveler satisfaction. Business expenses are identified as they occur, matched to travel context, and reimbursed quickly — or immediately, via stablecoin.

“Now travelers can earn points for paying and traveling. At most companies, travelers are forced to choose between following policy and earning the rewards they value,” said Brook Armstrong, Co-CEO, Blockskye. “Capture removes that tradeoff by aligning incentives through automation rather than enforcement.”

How It Works

Capture uses AI to identify business expenses automatically. The system analyzes transaction behavior alongside corporate travel itineraries. Approved expenses trigger fast reimbursement, often within days, so travelers are not left floating business costs and finance teams are not chasing receipts.

Capture integrates directly with enterprise ERP systems for point-of-sale budget validation, direct integration with corporate travel plans for transaction context, and uses immutable ledger records to support audit and compliance requirements.

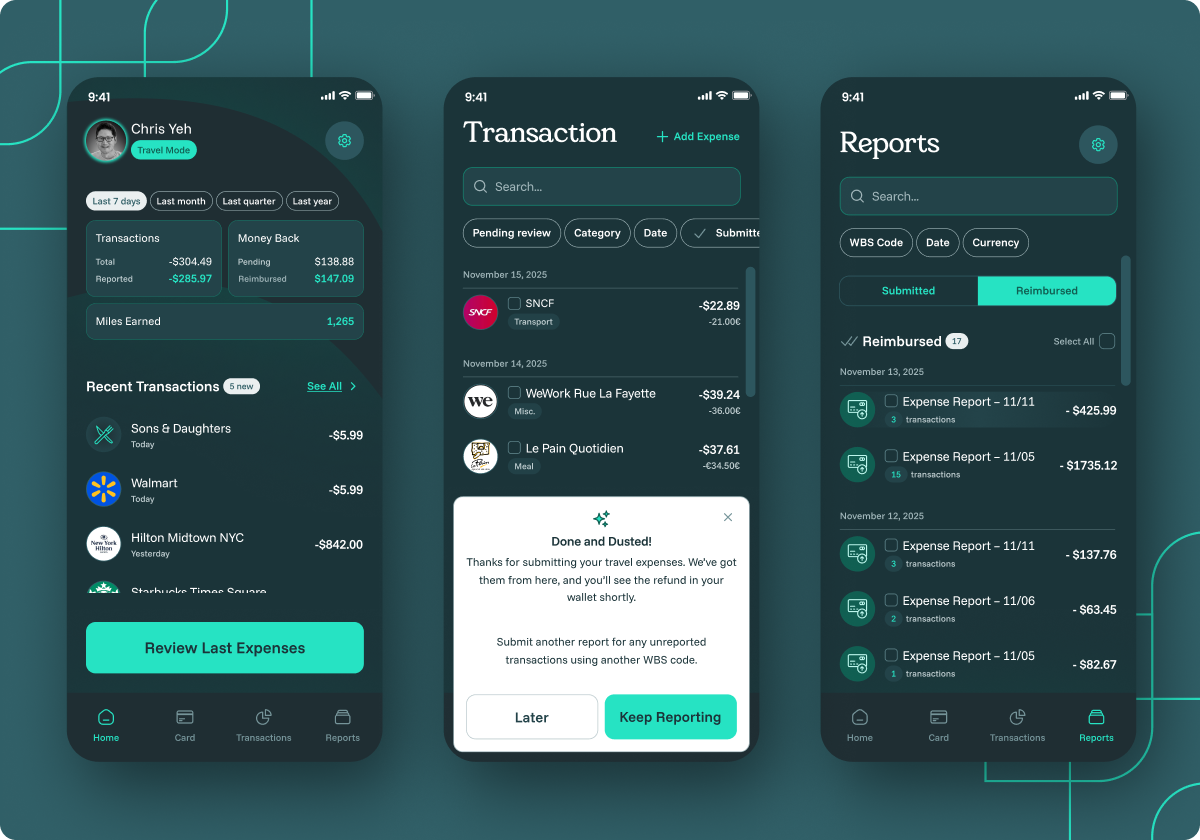

Blockskye Capture mobile interface showing real-time transaction tracking, automated expense classification, and reimbursement status for business travel expenses.

Benefits for Enterprises and Travelers

For enterprises, Blockskye Capture delivers:

Real-time spend visibility with audit-ready records tied to travel context

Proactive compliance control that reduces manual work, leakage, and transaction costs

For travelers, Blockskye Capture provides:

Choice and flexibility to use preferred personal credit cards while staying compliant

More value from every trip through loyalty points and status benefits, with faster and more predictable reimbursement

For airlines and hotels, Blockskye Capture provides:

Loyalty card access to coveted business travel spend — an untapped, major market

Direct-to-traveler relationships and built-in customer acquisition

Broader traveler research shows rewards shape behavior. In fact, 84% of travelers report using at least one points-optimizing tactic, which makes loyalty value a real driver of purchase decisions.

“Expense management shouldn’t be a source of friction for finance teams or travelers,” said Chris Yeh, Head of Product, Blockskye. “Blockskye Capture replaces manual processes with real-time automation that works for both the program and the traveler.”

The Math

With Blockskye Capture, the traveler can use a personal rewards card and keep the upside, often ~50,000 additional points or miles based on common 2x travel earn rates, plus progress toward elite status through spend-based status credit on many co-branded cards. The company still maintains real-time visibility, policy controls, and audit-ready records.

Learn More

To request a demo of Blockskye Capture or join the early access program, visit https://www.blockskye.com/contact.

About Blockskye

Blockskye provides modern infrastructure for enterprise travel, payments, and expense operations. By connecting financial controls, travel context, and automation in real time, Blockskye helps organizations reduce friction, improve transparency, and modernize corporate travel programs.